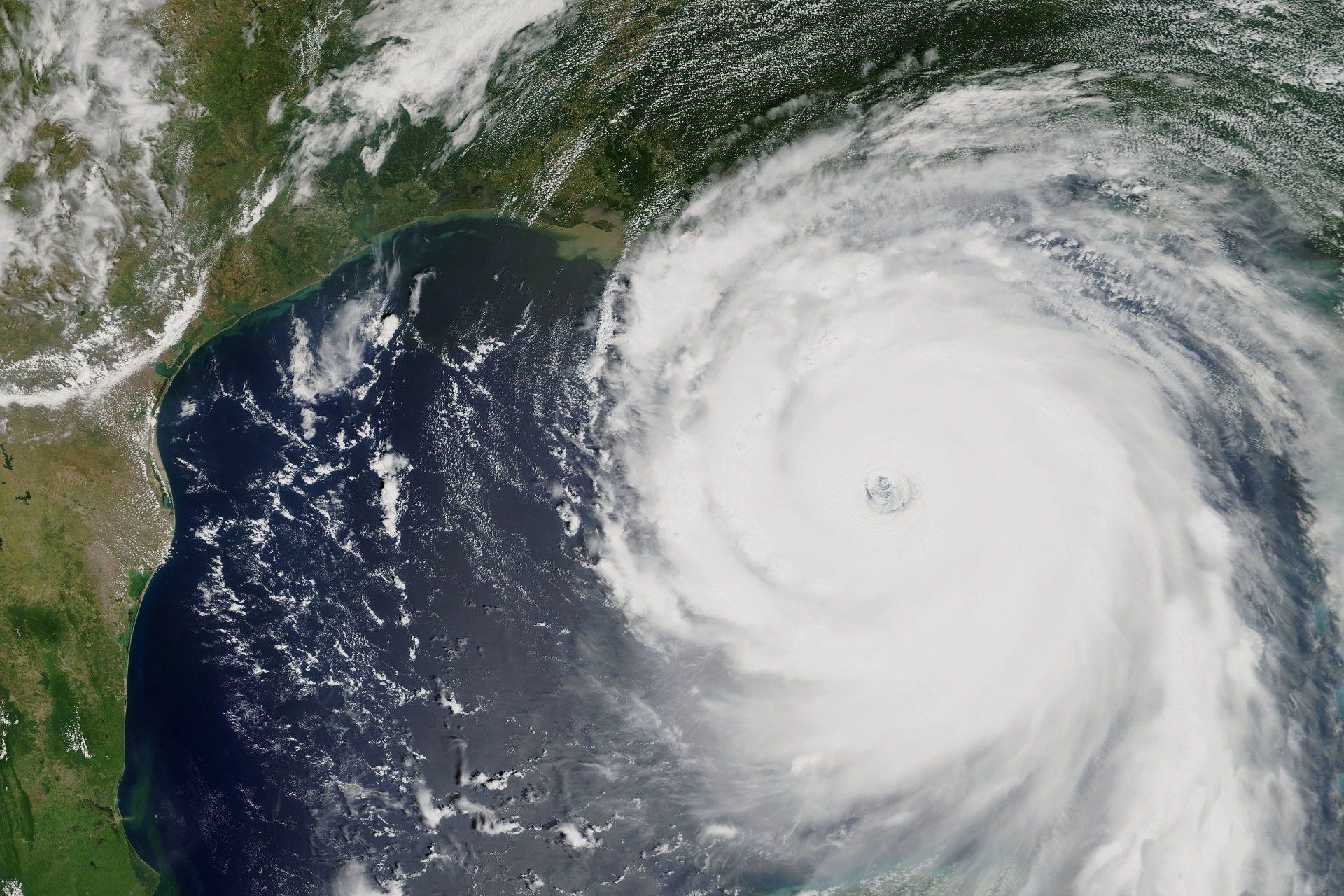

Making a Hurricane Damage Claim in Florida

Filing a hurricane damage claim in Florida – which may as well be considered a “when” and not an “if” given our current weather trends – but if you have not yet had to deal with the process of going through a claim for damage caused in a hurricane, then read ahead. In this article, we will discuss the details of what is covered, what you can’t claim on your homeowner’s insurance policy, and why you might need public adjuster assistance.

What is Covered and What is Not?

The extent of coverage all depends on the homeowner’s insurance policy that you have. The policy is the controlling document. A standard homeowner’s insurance policy will likely cover most of the incidental damage that occurs during a hurricane, despite the fact that the same dwelling can endure many different types of damage.

One thing that no basic policy covers are flooding. Even though a significant portion of the United States population lives in flood-prone or hurricane-prone areas, flooding is not included in a standard policy and must be purchased separately.

Because many areas in Florida are known to be high-risk areas for hurricanes, insurance companies may also require that you have separate windstorm insurance . This is because insurance companies are making a bet with you: you are betting something horrible will happen so they will pay you for it, and they are betting it won’t so they can use the premiums you pay them to reimburse other people. They aren’t going to cover the type of damage that occurs most often in your area because that isn’t good business for them.

Something else definitely not covered under your homeowner’s policy is damages due to negligence. For example, long-term damage that occurred before the hurricane hit will not be covered. This is why it is important to take pictures of your home regularly so you can prove the condition it before a disaster. Also, having a public adjuster assist you can help you determine the extent of the damage.

Lastly, your homeowner’s insurance will not cover damage to your vehicle that results from a natural disaster. It doesn’t matter if your car is parked in a garage which is technically part of your house, it will not be covered by your flood insurance or your homeowner’s insurance, so if you live in a hurricane zone, make sure you make elections on your auto policy that will cover damage to your vehicle.

What Types Of Damage Are You Claiming?

There are three key types of damage you will deal with in a hurricane:

1. Wind Damage

This isn’t just the damage that the wind causes by itself. It also encompasses the debris kicked up by high storm winds that can be flung at your property and break your windows.

This is one of the reasons it is key to have photographic evidence of the condition of your windows before and after the storm. Significant structural damage can result from the wind picking up items as large as trees and carrying them for miles, so this type of damage can occur even if you are miles inland from the storm.

2. Water Damage

Images of the flooded streets following Hurricane Katrina are what most people think of when they hear “hurricane” and for good reason. Tropical storms come with a hearty helping of rainfall, and frequently flooding results from the rainfall having nowhere to go.

Flood insurance is necessary to be reimbursed for the damage caused by standing water in areas where there is no water under usual circumstances. Yet, your regular policy will cover damage that occurs as a result of the wind damaging your roof and subsequent water damage from the rain getting in during the same storm.

3. Fire Damage

This is something that probably not a lot of people stop to consider. Fire? During a rainstorm? Well, yes. Power outages and power surges, combined with power lines down in the storm and leaks and flooding can result in nasty electrical fires.

For this reason, if you are instructed to evacuate in a hurricane, unplug as many of your appliances as you can. Your insurance company may not pay for damage caused by a fire that results from your negligence in securing your property and making sure that further damage does not occur.

Dealing with the Damage

Your home may not be safe in the aftermath of the disaster, but as soon as you are allowed back to your residence, make sure to take plenty of pictures. Having public adjuster assistance can make this daunting task more palatable.

Don’t throw anything out. Not until your insurance company’s adjuster has had time to take a look at the damage and begin their report. Sadly, they deal with fraud all the time, and you will need to be able to prove the items you had that were damaged in order to recover money for them.

Empower Your Claim with Continental Public Adjusters

In the intricate world of property claims, Continental Public Adjusters emerges as your beacon of expertise and support in Florida. With a profound understanding of the nuances involved, our skilled team is dedicated to ensuring you receive the maximum benefits from your insurance policy.

Whether you're facing a fresh property claim or grappling with the complexities of a denied, delayed, or underpaid claim, the role of an adept public adjuster cannot be overstated.

Here are five compelling reasons why Continental Public Adjusters is your optimal choice:

- Your Resolute Advocate: Our unwavering commitment is to secure the highest compensation possible for your loss.

- Thorough Analysis: We delve deep into the specifics of your loss, conducting a meticulous investigation. Our team of experts and consultants work tirelessly to determine the precise value of your property loss.

- Precision Estimation: Leveraging advanced cost estimating software, we craft comprehensive supporting documentation, promptly submitted to your insurance provider.

- Expert Negotiation: We adeptly manage your claim, engaging in negotiations with your insurance company's adjuster to secure a settlement aligned with your best interests and approval.

- Maximizing Your Entitlements: With the insight gained from settling thousands of claims, we foresee potential issues and hurdles in the claims process. Our unwavering commitment is to ensure you receive the maximum benefits you deserve.

Embark on this journey with us through a complimentary consultation with one of our experienced team members. With 38 years of invaluable experience successfully resolving a myriad of claims, spanning both personal and commercial properties in Florida, Continental Public Adjusters, Inc. is your trusted ally.

Initiate your FREE claim review today by contacting us at (800) 989-4769 or via email at info@contpa.com.

Disclaimer: The information on this website and blog is for general informational purposes only and is not professional advice. We make no guarantees of accuracy or completeness. We disclaim all liability for errors, omissions, or reliance on this content. Always consult a qualified professional for specific guidance.